2024 Autumn Statement, Webinar invitation

The Chancellor, Rachel Reeves, will present her first Budget under the new Labour government in the House of Commons on Wednesday 30th October 2024.

The Chancellor, Rachel Reeves, will present her first Budget under the new Labour government in the House of Commons on Wednesday 30th October 2024.

Exeter based chartered accountancy firm Bush & Co has merged with UK wide firm Streets Chartered Accountants and the combined firm will be known as Streets Bush Limited.

From the end of last year, HMRC has raised the maximum tax debt eligible for online Time to Pay arrangements. The new limits are £30,000 for individuals and £50,000 for businesses.

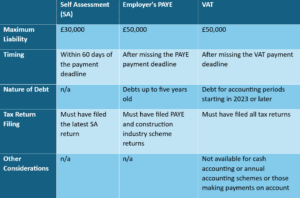

Taxpayers who are unable to settle their tax bills can apply online to arrange a Time to Pay plan with HMRC. This option is available for individuals with self-assessment (SA) liabilities, employers with PAYE (Pay As You Earn) debts, and businesses with unpaid VAT bills.

According to HMRC’s guidelines, the criteria for applying for a payment plan online are as follows:

One of the stand out policies announced in the chancellor’s recent budget, particularly given our geographical location and the size of our tourism industry, was the abolition of the preferential tax treatment of Furnished Holiday Lets (FHLs).

Chancellor Jeremy Hunt delivered his ‘Budget for Long Term Growth’ on Wednesday 6 March 2024. His speech promised ‘more investment, more jobs, better public services and lower taxes’.

For individuals engaged in additional income streams alongside their regular employment or those participating in sales through popular resale platforms such as eBay, Vinted, or Etsy, recent modifications in tax reporting, often referred to as the ‘Side Hustle Tax,’ have garnered attention.

As we approach the end of 2023 and gear up for 2024, it’s crucial to stay informed about regulatory changes and compliance requirements. Bush & Co is here to guide you through these dates to ensure a smooth financial journey.

Dive into the dynamic economic landscape as Jeremy Hunt unveils the ‘Autumn Statement for Growth’ in 2023. From National Insurance reforms to business incentives, explore the pivotal changes shaping the fiscal future and driving economic resilience.

Following the enactment of the Economic Crime and Corporate Transparency Act, small businesses are now required to submit a profit and loss statement to Companies House.